The Process of Offshore Business Formation: A Detailed Overview for New Entrepreneur

The process of overseas Business Formation is an essential journey for brand-new business owners. It needs cautious factor to consider of different aspects, such as territory and Business structure. Each step, from choosing an area to maintaining conformity, plays an essential function in the success of the venture. Recognizing these elements can be complicated. Nevertheless, comprehending each phase is vital for guiding via the complexities of developing a profitable offshore company. What comes next may amaze many aspiring company proprietors.

Recognizing Offshore Business Development

Offshore Business Formation has ended up being progressively preferred among business owners seeking to maximize their operations and tax responsibilities. This procedure involves establishing a service entity in an international jurisdiction, commonly to make the most of favorable regulative environments, tax obligation incentives, and enhanced personal privacy. Entrepreneurs often select offshore Formation for numerous reasons, including property defense, lowered taxation, and enhanced market access.

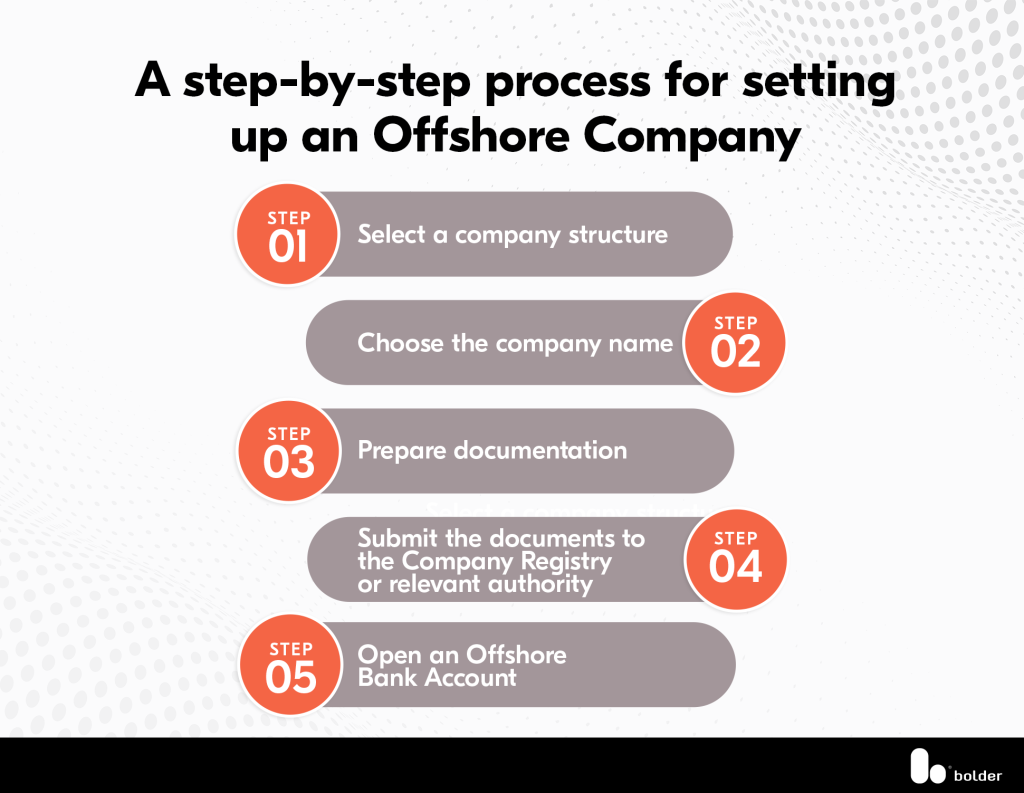

The fundamental elements of offshore Business Formation consist of picking the appropriate Business structure, such as a corporation or limited obligation business. Business owners should also navigate legal requirements, such as enrollment, conformity with regional regulations, and the visit of supervisors or policemans. In addition, understanding the effects of international laws, banking arrangements, and reporting commitments is crucial.

Eventually, overseas Business Formation offers calculated advantages, but it requires mindful consideration and thorough understanding of the linked processes and laws to ensure conformity and optimize advantages.

Picking the Right Territory

When selecting a jurisdiction for Business development, what variables should business owners consider to guarantee excellent end results? The legal structure is important; territories with steady regulations and strong security for businesses commonly cultivate a positive atmosphere. Tax ramifications additionally play a significant function; lots of business owners seek reduced or no company taxes, which can boost profitability.

Additionally, the track record of the territory is crucial; a well-regarded area can boost integrity and draw in capitalists. Business owners must additionally consider the ease of doing service, consisting of the simpleness of registration processes and continuous compliance requirements.

Accessibility to proficient labor and Business facilities can considerably influence operational performance. Lastly, recognizing local policies and prospective language barriers can aid reduce risks (Offshore Company Formation). By thoroughly examining these variables, business owners can select a territory that lines up with their Business objectives and optimizes their opportunities for success in the overseas market

Preparing the Essential Paperwork

Picking the ideal territory prepares for effective Business formation, yet entrepreneurs should likewise focus on the documents needed to establish their companies successfully. Essential papers generally include a service strategy, posts of consolidation, and recognition for all directors and shareholders. Entrepreneurs must also prepare a memorandum of association, which details the company's function, and a licensed office address in the chosen jurisdiction.

In addition, depending on the nature of the service, licenses or licenses may be essential to conform with regional policies. Financial statements, an operating contract, and tax obligation recognition numbers may also be needed.

It is vital for entrepreneurs to guarantee that all documentation is exact and thoroughly examined, as insufficient or incorrect entries can bring about rejections or delays. Seeking specialist aid may aid in steering jurisdiction-specific demands, making sure that all needed paperwork is effectively planned for a smooth Formation procedure.

Registering Your Offshore Firm

To efficiently sign up an overseas company, entrepreneurs should navigate the specific processes set forth by their chosen territory. This commonly entails selecting an unique company name that adheres to neighborhood regulations and filing the needed application. Entrepreneurs ought to prepare to give details concerning business ownership, structure, and monitoring.

Next off, they have to submit needed documents, such as evidence of more tips here identity and address for directors and link investors, in addition to the business's Memorandum and Articles of Association.

Payment of enrollment charges is also crucial, which can differ significantly by territory. After entry, the registration authority will review the application, which may take anywhere from a few days to a number of weeks.

Once approved, entrepreneurs will certainly obtain a certification of incorporation, marking the main facility of their offshore company. This crucial action lays the foundation for additional Business tasks and conformity with regional regulations.

Maintaining Conformity and Managing Your Offshore Business

How can entrepreneurs assure their offshore Business remains certified while efficiently managing its operations? To identify compliance, entrepreneur need to acquaint themselves with the laws and regulations of the jurisdiction where their overseas business is registered. Regularly upgrading their expertise on tax obligation responsibilities, reporting requirements, and local Business regulations is vital.

Furthermore, hiring regional legal and monetary experts can provide valuable insights and help. Applying robust inner controls and record-keeping systems more aids in keeping conformity. Routine audits can determine prospective concerns before they intensify.

Efficient monitoring likewise includes establishing clear interaction networks with stakeholders and assuring all staff members are learnt compliance matters. Making use of overseas software application services can improve operations and boost transparency. By focusing on conformity and monitoring strategies, entrepreneurs can decrease threats and cultivate a secure setting for their overseas company, eventually adding to its long-lasting success.

Regularly Asked Concerns

What Are the Tax Effects of Offshore Business Formation?

The tax ramifications of overseas Business Formation differ by territory, consisting of prospective tax benefits, minimized prices, and compliance requirements. Entities have to think about local legislations, international treaties, and the influence on their total tax obligation technique.

Can I Open a Financial Institution Account Remotely for My Offshore Business?

Yes, individuals can open a savings account from another location for their offshore company, given they satisfy the financial institution's requirements. This frequently includes sending essential paperwork and validating the identification of the service owner and the firm itself.

Are There Any Kind Of Limitations on Foreign Ownership in Offshore Jurisdictions?

How much time Does the Offshore Business Registration Refine Normally Take?

The offshore business registration procedure usually takes between one to 4 weeks, relying on the territory and the complexity of the business framework. Factors such as paperwork efficiency can affect the general timeline substantially.

What Are the Costs Connected With Preserving an Offshore Service?

Keeping an overseas Business generally incurs expenses such as annual enrollment costs, compliance expenditures, accounting services, and potential lawful charges, which can differ substantially based upon jurisdiction and particular Business requirements, impacting overall operational expenditures.

Offshore Business Formation has ended up being progressively prominent amongst business owners seeking to enhance their operations and tax liabilities. The fundamental elements of offshore Business Formation include selecting the suitable Business structure, such as a company or restricted liability company. To determine conformity, Business proprietors should acquaint themselves with the regulations and regulations of the jurisdiction where their offshore business is registered. The tax obligation effects of overseas Business Formation differ by territory, consisting of potential tax obligation benefits, decreased rates, and compliance needs (Offshore Company Formation). The overseas business enrollment procedure generally takes between one to 4 weeks, depending on the territory and the complexity of the Business framework